Jan 30, 2024For help with interest: Call the phone number listed on the top right-hand side of the notice. Call 800-829-1040. Use telephone assistance. Contact your local Taxpayer Assistance Center. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

How to avoid a bad tax preparer when it’s time to file your return – cleveland.com

Feb 8, 2024Or, if you can demonstrate reasonable cause for the failure to pay your tax debt on time, the IRS might consider a penalty abatement. This doesn’t reduce the actual tax debt but eliminates or

Source Image: wsj.com

Download Image

Apr 24, 2023Determining how much you owe and why has been a challenge for some taxpayers due to the IRS backlog that consists of millions of unprocessed returns that accumulated during the COVID-19

Source Image: pbs.org

Download Image

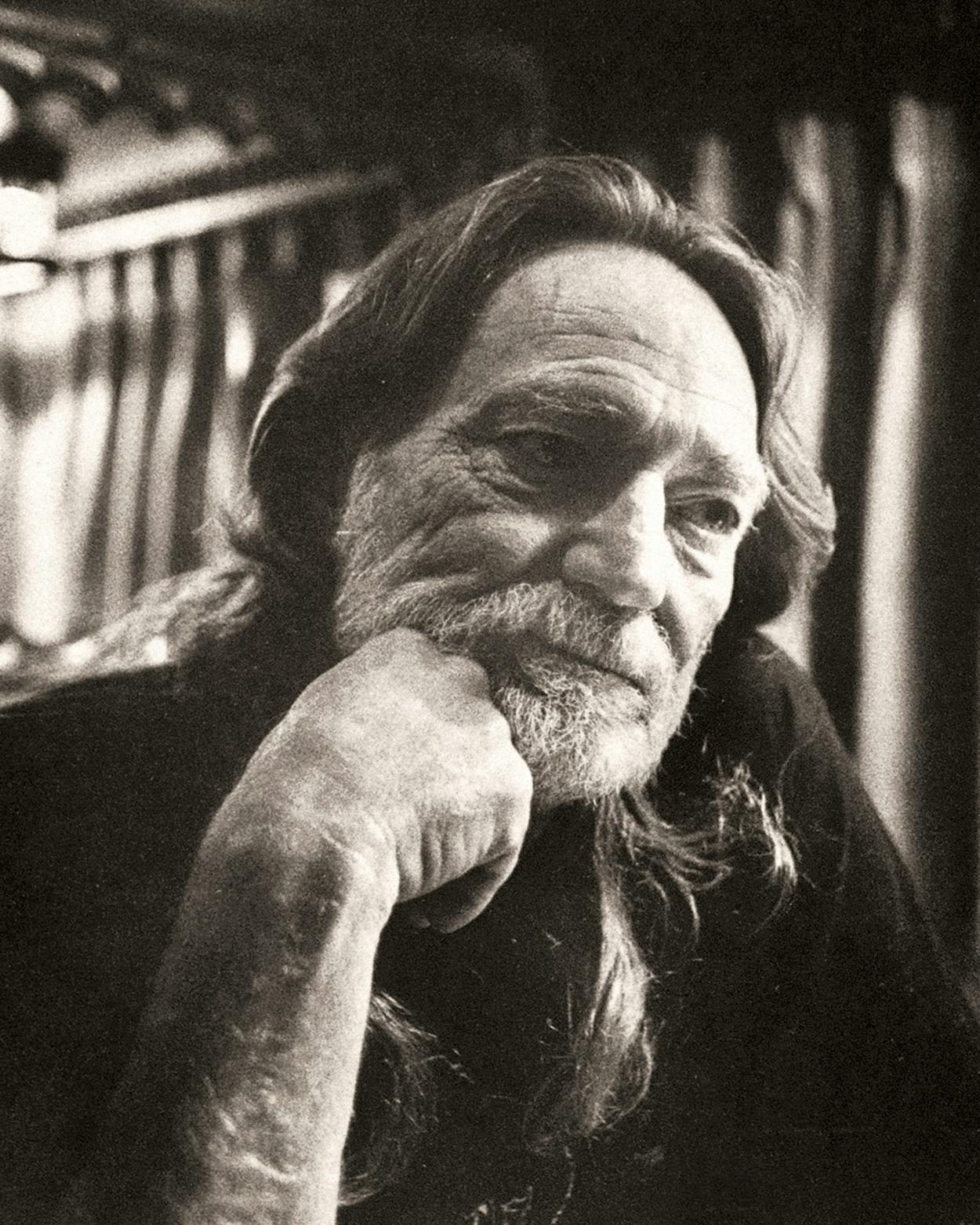

Poor Willie – Texas Monthly The IRS updates the site once a day, and it indicates whether your return was received, whether your refund is approved and whether the IRS has sent it to you. If it has been at least 21 days

Source Image: neamb.com

Download Image

Why Doesn’T The Irs Tell You What You Owe

The IRS updates the site once a day, and it indicates whether your return was received, whether your refund is approved and whether the IRS has sent it to you. If it has been at least 21 days A tax refund happens when you’ve paid more than you legally owe to the IRS; in other words, you’ve overpaid the government during the tax year, and your refund makes you whole come tax time. When

7 Smart Reasons You Should Do Your Taxes Early | NEA Member Benefits

In 2006, President Barack Obama’s chief economist, Austan Goolsbee, suggested a ” simple return ,” in which taxpayers would receive already completed tax forms for their review or correction. 2023 Tax Tips for Family Caregivers

Source Image: familycaregiversonline.net

Download Image

Taxes 2023: Why Doesn’t the IRS Just Send a Bill? (It’s Complicated) In 2006, President Barack Obama’s chief economist, Austan Goolsbee, suggested a ” simple return ,” in which taxpayers would receive already completed tax forms for their review or correction.

Source Image: finance.yahoo.com

Download Image

How to avoid a bad tax preparer when it’s time to file your return – cleveland.com Jan 30, 2024For help with interest: Call the phone number listed on the top right-hand side of the notice. Call 800-829-1040. Use telephone assistance. Contact your local Taxpayer Assistance Center. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

Source Image: cleveland.com

Download Image

Poor Willie – Texas Monthly Apr 24, 2023Determining how much you owe and why has been a challenge for some taxpayers due to the IRS backlog that consists of millions of unprocessed returns that accumulated during the COVID-19

Source Image: texasmonthly.com

Download Image

IRS Will Use AI to Restore Tax Fairness and Stop Tax Evasion Schemes – MishTalk May 23, 2023Paper returns take much longer because the IRS must process the information manually before the computer system can screen it. “Currently, information from paper-filed returns is manually input

Source Image: mishtalk.com

Download Image

How are dividends taxed? 2023 Dividend Tax Rates | The Motley Fool The IRS updates the site once a day, and it indicates whether your return was received, whether your refund is approved and whether the IRS has sent it to you. If it has been at least 21 days

Source Image: fool.com

Download Image

Tax season is under way. Here are some tips to navigate it | AP News A tax refund happens when you’ve paid more than you legally owe to the IRS; in other words, you’ve overpaid the government during the tax year, and your refund makes you whole come tax time. When

Source Image: apnews.com

Download Image

Taxes 2023: Why Doesn’t the IRS Just Send a Bill? (It’s Complicated)

Tax season is under way. Here are some tips to navigate it | AP News Feb 8, 2024Or, if you can demonstrate reasonable cause for the failure to pay your tax debt on time, the IRS might consider a penalty abatement. This doesn’t reduce the actual tax debt but eliminates or

Poor Willie – Texas Monthly How are dividends taxed? 2023 Dividend Tax Rates | The Motley Fool May 23, 2023Paper returns take much longer because the IRS must process the information manually before the computer system can screen it. “Currently, information from paper-filed returns is manually input